BTC Price Prediction: Analyzing the Path to $200,000

#BTC

- Technical Strength: BTC trading above 20-day MA with Bollinger Band support at $106,958 provides solid technical foundation for upward movement

- Institutional Adoption: Expanding corporate treasury allocations and traditional finance entry into crypto space creating sustained demand pressure

- Market Momentum: Approaching critical $113,000 threshold with positive sentiment driving toward higher resistance levels

BTC Price Prediction

Technical Analysis: BTC Shows Bullish Consolidation Above Key Moving Average

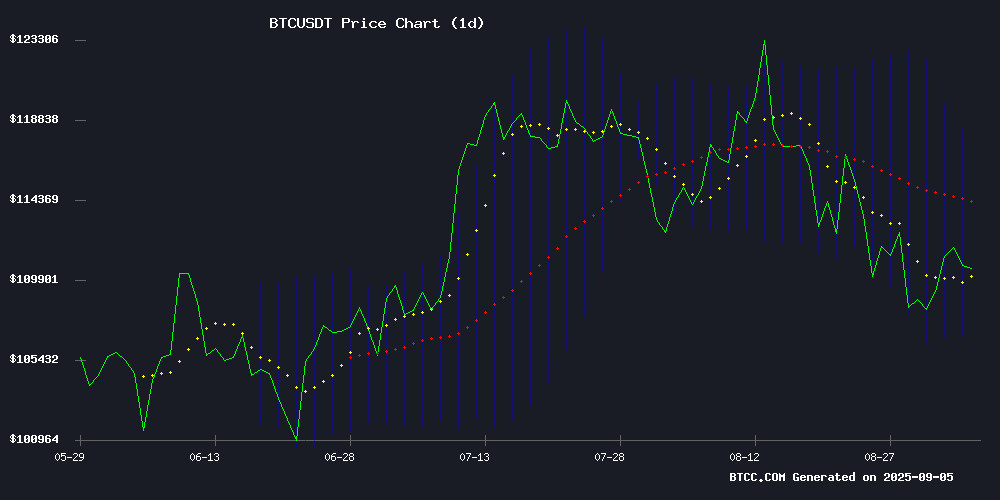

BTC is currently trading at $112,570.84, holding firmly above the critical 20-day moving average of $112,288.65, indicating sustained bullish momentum. The MACD reading of -0.6202 suggests minor short-term bearish pressure, though the overall trend remains positive. Bollinger Bands show price action NEAR the middle band with upper resistance at $117,619.11 and lower support at $106,958.18, providing clear levels for potential breakout or consolidation.

According to BTCC financial analyst Michael, 'The technical setup suggests BTC is building a solid foundation for another leg higher. Maintaining above the 20-day MA is crucial for continued upward movement toward the $117,600 resistance level.'

Market Sentiment: Positive Fundamentals Support BTC's Ascent

Current market sentiment remains overwhelmingly bullish as Bitcoin approaches the critical $113,000 threshold. Positive developments including Tether's expansion into gold mining investments and Marathon Digital's treasury accumulation during market downturns demonstrate institutional confidence. The debate around cryptocurrency longevity and Bitcoin's network developments, despite minor concerns about network congestion, contribute to a constructive outlook.

BTCC financial analyst Michael notes, 'The fundamental backdrop continues to strengthen with traditional finance players expanding their crypto exposure. While short-term volatility persists, the structural adoption story remains intact and supportive of higher price targets.'

Factors Influencing BTC's Price

Why Crypto Is Here to Stay: The Debate That Matters

Nikhil Kamath's podcast hosted a pivotal discussion on the future of cryptocurrencies, featuring Ruchir Sharma of Rockefeller Capital Management. The debate underscored Bitcoin's enduring relevance and the broader crypto market's mainstream acceptance. "Crypto is here to stay," Sharma declared, citing institutional adoption as a turning point. Banks and asset managers once dismissive of digital assets are now allocating capital—a clear signal of legitimacy.

India's regulatory stance drew sharp scrutiny. Kamath highlighted the divergent treatment of blockchain-based platforms like Polymarket versus traditional counterparts, warning against innovation-stifling policies. Stablecoins and Bitcoin's rivalry with gold emerged as key themes, reflecting crypto's evolving role in global finance.

Adam Back Raises Alarm Over JPEG Spam Clogging Bitcoin Network

Blockstream CEO Adam Back has sounded the alarm on a 20% surge in JPEG inscriptions on Bitcoin's blockchain between May and September 2025, with files growing from 88 million to 105 million. The spam-like activity consumed 7,000 BTC ($700 million at $100,000/BTC) in fees—averaging $8 per image—through Taproot inscriptions.

"Bitcoin is owned by humanity," Back tweeted on September 5, 2025. "The protocol developers are stewards, and need consensus from users to change it materially. Bitcoin is about money—spam has no place in the timechain." The comments reignite debates about network bloat as non-financial data crowds the blockchain.

Miners lack protocol control, Back emphasized, noting economic nodes ultimately govern Bitcoin. The block-size wars proved market forces—not hash power—determine network rules. With JPEGs permanently etched into transactions, the debate now centers on preserving Bitcoin's monetary utility versus allowing alternative data uses.

Tether Explores Gold Mining Investments to Diversify Crypto Profits

Gold mining stocks gained traction following reports that Tether, the stablecoin issuer, is considering investments in the sector. Barrick Mining (B) rose 0.7%, Newmont Mining (NEM) climbed 0.6%, and the VanEck Gold Miners ETF (GDX) advanced 0.65%. The move signals Tether's strategy to hedge against crypto volatility by allocating capital to traditional safe-haven assets.

Tether's interest spans the entire gold supply chain, including discussions with mining firms and royalty companies. A $105 million stake in Elemental Altus, a Toronto-listed gold royalty firm, was secured in June. CEO Paolo Ardoino has likened gold to 'natural Bitcoin,' underscoring its role as a store of value amid market turbulence.

Tether Expands into Gold Industry

Tether is aggressively diversifying its gold investments, moving beyond its current $8.7 billion in gold bars. The stablecoin issuer now targets gold mining, refining, trading, and royalty businesses to bolster asset backing. A $105 million stake in Toronto-listed Elemental Altus was acquired in June, followed by an additional $100 million injection.

CEO Paolo Ardoino positions gold as a safer store of value than fiat currencies and a strategic complement to Bitcoin. The expansion signals Tether's ambition to dominate gold-backed digital finance, merging traditional safe-haven assets with cryptocurrency innovation.

Marathon Digital Holdings Expands Bitcoin Treasury Amid Market Downturn

Marathon Digital Holdings (MARA) increased its Bitcoin reserves to 52,477 BTC in August, mining 705 BTC during the month without selling any. The company maintained a 4.9% share of network rewards, producing 208 blocks, while its energized hashrate rose 1% to 59.4 EH/s. CEO Fred Thiel cited the 6% August price decline as a strategic opportunity to accumulate more BTC.

The miner remains on schedule to complete its Texas wind farm buildout by Q4, with all miners operational. Internationally, MARA agreed to acquire a 64% stake in Exaion, a subsidiary of French energy giant EDF, with an option to increase ownership to 75% by 2027. The deal aligns with MARA's push into AI and edge computing infrastructure.

Despite opening a European headquarters in Paris to emphasize sustainability initiatives, MARA shares fell 5% on Thursday and are down 14% year-to-date. The company's focus on grid partnerships and repurposing unused energy underscores its long-term commitment to environmentally conscious mining.

Bitcoin Surges as it Targets the Critical $113,000 Threshold

Bitcoin has redirected its trajectory upwards, trading around $112,800 as of September 5, 2025. The $113,000 mark is now a focal point for technical analysts, serving as a pivotal threshold for determining the cryptocurrency's future momentum.

Analyst Rekt Capital confirmed a technical breakout, emphasizing the necessity of a daily close or retest above $113,000 to sustain bullish momentum. The red band on price charts underscores this level's significance as a resistance point. A successful hold above this threshold could propel Bitcoin toward the $116,000–$119,000 range.

Market participants are watching closely as Bitcoin reenters a testing phase following the breach of a downward trend line. The validation of this breakout could set the stage for further gains, reinforcing the importance of overcoming current resistance levels.

Bitcoin Surges to $113K as Market Dominance Nears Two-Week High

Bitcoin's price recovery accelerated ahead of the U.S. jobs report, climbing to $113,000—its highest level since late August. The cryptocurrency recorded its first higher high since mid-August's all-time peak of $124,000, signaling a potential bullish reversal. Market dominance rose to 59%, reflecting renewed capital inflows into BTC after a period of rotation into ether.

The rebound from Asian session lows may stem from max pain theory, where option sellers push prices toward $112,000 to maximize losses for buyers. Over $3.28 billion in BTC options expired on Deribit, with max pain aligning precisely with the day's price action. Institutional activity appears to be driving this strategic positioning as expiry approaches.

Trump-Linked Bitcoin Miner Crashes Below IPO Price After Nasdaq Debut

American Bitcoin Corp (ABTC) shares plummeted 15% to $6.83 on Thursday, dipping below its $6.90 IPO price just one day after its Nasdaq listing. The stock had briefly surged to $14.65 during morning trading before succumbing to afternoon volatility—a pattern common among newly public companies during price discovery phases.

The miner, 80% owned by Hut 8 and 20% by Donald Trump Jr. and Eric Trump, holds 2,443 BTC ($269M). Its reverse merger with Gryphon Digital Mining preceded a filing for a $2.1B at-the-market equity raise to expand bitcoin holdings. Bitcoin treasury firms like ABTC face investor skepticism due to persistent premiums over underlying asset values.

Will BTC Price Hit 200000?

Based on current technical indicators and market fundamentals, reaching $200,000 represents a plausible but ambitious target that would require sustained bullish momentum and continued institutional adoption. The current price of $112,570 represents approximately a 78% increase needed to achieve this milestone.

| Target Price | Required Gain | Current Support | Key Resistance |

|---|---|---|---|

| $200,000 | +77.8% | $106,958 | $117,619 |

| Timeframe Estimate | 6-18 months | Risk Level | Moderate-High |

BTCC financial analyst Michael suggests, 'While $200,000 is achievable within the next 12-18 months, investors should monitor the $117,600 resistance level closely. A sustained break above this level could accelerate momentum toward higher targets, though market conditions and regulatory developments will play crucial roles in this journey.'